Table of Content

- How to get Bank of Baroda home loan statement?

- How can I check my mini statement in BOB ATM?

- Give happiness a whole new meaning with home loan starting @8.60%

- Baroda Home Suvidha Personal Loan

- ✅ Is there any moratorium or holiday period available with Bank of Baroda Home Loans?

- LinkedIn respects your privacy

- Baroda Home Loan : Interest rates & charges

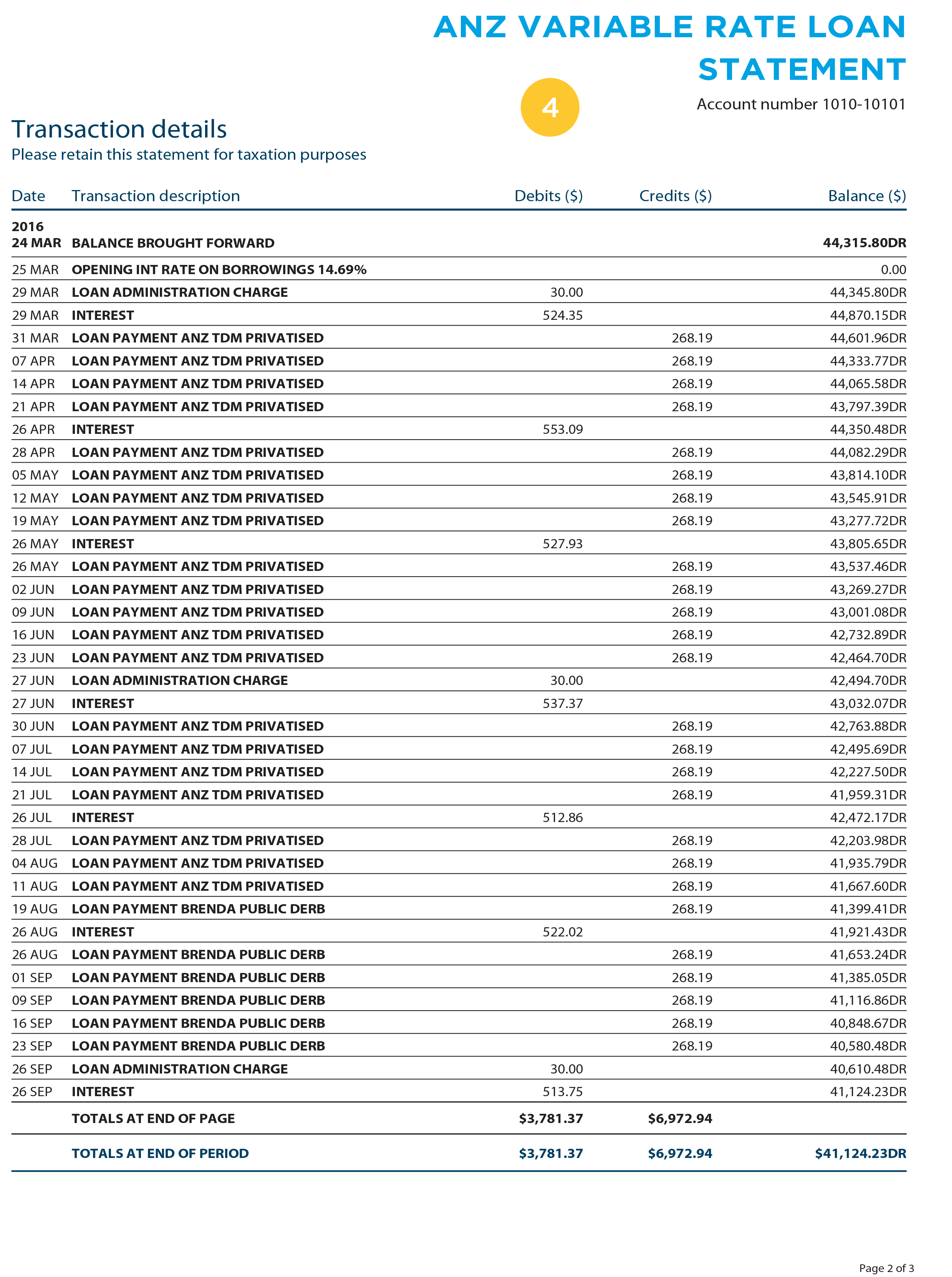

Make positive you’ve got got sufficient cash for your account in case you installation an auto-pay. If you don’t, you will be charged a charge for being not able to pay. You must explore all the techniques of getting the mini statement and all of them are free of cost and convenient to follow. You can pay over and above the EMI to close the Home Loan early. Lump-sum deposit in home loan or part payments as per the comfort of the borrower can be made. Home Loan borrowers to submit duly filled in prescribed Application Form to the concerned Branch along with other documents as per the scheme guidelines.

Under the scheme, the borrower has the option to deposit all his savings in the linked SB account to avail maximum benefit of interest in the Home Loan account. Generally, we accept mortgages of the constructed or purchased property as collateral. In some cases, collateral for home loans can be accepted in the form of insurance policies, government promissory notes, shares and debentures, gold ornaments and other property etc. Bank of Baroda grants a home loan depending based on the applicant's repaying capacity that is based on their age, assets, income, the stability of job, liabilities and so on. Per unit based on the area where the property is or shall be constructed. The most critical and crucial stage where the bank can approve or reject your loan as per the data provided and verification done earlier.

How to get Bank of Baroda home loan statement?

The best thing about all the methods is that all of them are free of cost and some of them will help you to have the Bank of Baroda Balance Check. You can make use of any method to get the mini statement of the Bank of Baroda. So, it will be easy for you to make a good financial decision once you keep an eye on your previous transactions. Loan amount is determined on the basis of the repaying capacity of the applicant/s.

Aspiring home owners can use the Bank of Baroda home loan for a variety of purposes. You can buy a plot, purchase a flat, build your own home or even extend your existing residence. This facility is for customers who do not have account with Bank. It is a rate of interest at which the bank lends funds to the borrower for buying / constructing a house / buying flat.

How can I check my mini statement in BOB ATM?

To whole the offline process, visit your bank’s nearest department and ask an respectable for the assertion. When soliciting for the loan assertion in person, you’ll want to offer facts consisting of your loan account number, PAN, date of birth, and so on. Home loan account statements additionally function evidence which you have made all your loan payments. They also can make getting any other loan less difficult due to the fact they display which you are able to repaying the loan amount which you borrowed previously. These are the possible methods to get the Bank of Baroda mini statement on your mobile phone.

While, a co-applicant should be a minimum of 18 years old. You can get maximum home loan amount up to Rs 10 Crore basis your repayment capacity and valuation of property. Statement of accounts for all existing loan accounts for the last 1 year.

Give happiness a whole new meaning with home loan starting @8.60%

You can avail of a Top-Up up to 5 times during the loan period. Co-applicant may or may not be a joint owner of the property. Option to add a co-applicant for enhancing Bank of Baroda Housing Loan eligibility.

In case of farmers / agriculturists, repayment can be allowed in Half Yearly installments coinciding with harvesting/marketing of major crops produced. Slippage of the account into NPA category due to death of the borrower can be avoided. It is a group insurance scheme, which protects against unforeseen consequences of death of borrower. In case of farmers/agriculturists, repayment can be allowed in Half Yearly Instalments coinciding with harvesting/marketing of major crops produced. A person registered as Overseas Citizen of India under section 7 A of the Citizenship Act, 1955. The people taking this up should be a senior citizen of India, above 60 years of age.

You can pay over and above the EMI to repay the home loan faster. Copy of all the previous vendors’ agreements duly stamped and registered and the registration receipts. One should note that there must of adequate amount left to meet your monthly expenditure and other obligations. Upgrade your residence with home renovation loans from Bank of Baroda. Renovating your home can be a costly affair, but our home improvement loan can turn your dream home into reality.

The bank informs the essential details through an official sanction letter that confirms that your home loan is approved. People in groups or a housing society of 20 members are also eligible for this loan. The bank will also consider current financial obligations such as Car Loan, Personal Loan or Credit Card outstanding before calculating home loan eligibility. The Risk Premium of 0.05% will be applicable for customers not obtaining credit insurance cover.

The main benefit of this scheme is that one can take over their existing home loans from other banks to this scheme of Bank of Baroda. This is applicable for both residents of India as well as NRIs. All the individuals who are already borrowers of home loan including NRIs/PIOs, staff and ex-staffs are eligible for this scheme, whose asset classification is standard. If your Fixed Deposit is linked to your Savings Account, login with your User ID and Password to view and download your TDS Certificate.

BRLLR resets each month, thus customers will get latest applicable Bank of Baroda Housing Loan interest rate. Standardised documentation and processing for easy loan application. BOB Home loan applicants also get free accidental insurance. Make positive you recognize and examine the phrases and situations of your loan account so there are no surprises while you obtain your property loan. Set up an auto-pay or direct debit pay on your payments to deduct cash from your preferred financial institution account automatically. You won’t must fear approximately past due costs this way.

Therefore, people prefer mini-statement that has information about the last 10 transactions. So, here you can see various methods through which you can get the Bank of Baroda mini statement and see the last 10 transactions. You can have the statement through an SMS or BOB internet banking and plan your future expenses. Let’s explore all the possible methods to have the mini statement of Bank of Baroda.

Moratorium period up to 36 months after the loan amount is disbursed. The approved home loan amount varies according to location and income of the applicants. Bank of Baroda focuses on its employees, offering a career rather than just a job.